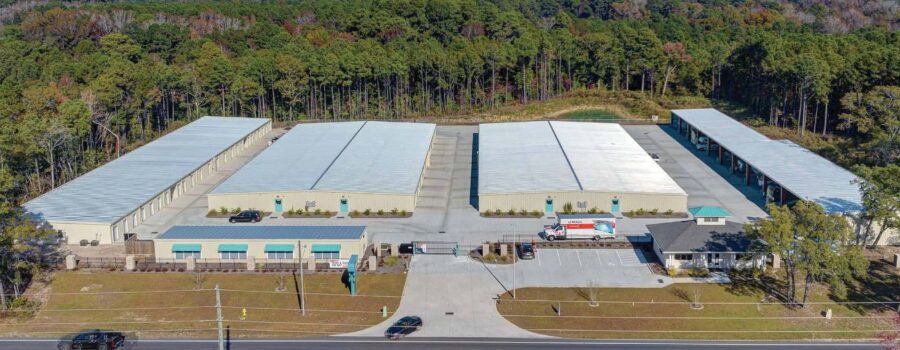

Algenon Cash, managing director of Wharton Gladden & Company, announces the acquisition of Fayetteville Storage Solutions, a 350-unit self-storage facility located in Fayetteville, North Carolina. The acquisition, valued at $12.4 million, was completed through a strategic partnership with a national storage operator and management firm, further solidifying Wharton Gladden’s commitment to expanding into high-growth markets.

The transaction was financed through a combination of a $9 million CMBS loan and $3.4 million in private equity, demonstrating Wharton Gladden’s expertise in structuring deals that maximize returns for its investors.

Investors in this acquisition are projected to receive a preferred annual return of 10%, with an internal rate of return (IRR) exceeding 19% and a cash-on-cash return of 8%. These strong financial projections highlight the investment appeal of Fayetteville Storage Solutions and Wharton Gladden’s proven track record in securing high-value assets in growth sectors.

Unlike typical value-add opportunities, Fayetteville Storage Solutions was acquired as a fully stabilized asset, offering immediate, consistent cash flow. Investors are projected to receive a preferred annual return of 9%, with an internal rate of return (IRR) exceeding 19% and a cash-on-cash return of 8%. These returns underscore the strength of the property’s solid operational foundation.

“We are excited to welcome Fayetteville Storage Solutions into our portfolio,” said Cash. “As a fully stabilized property, this acquisition aligns with our strategy of acquiring assets that offer immediate income. Our approach will focus on maintaining high occupancy levels and leveraging operational efficiencies to drive even greater value. With the strong fundamentals of this market, we believe this asset is positioned for continued success, and we anticipate a strategic exit within five years.”

Fayetteville Storage Solutions is ideally situated in a thriving market near Fort Liberty (formerly Fort Bragg), one of the largest military installations in the U.S. The facility offers a diverse range of storage options, including climate-controlled units, vehicle storage, and 24-hour access, catering to a broad demographic of residential and commercial customers.

Given its fully stabilized status, Wharton Gladden’s management team will focus on sustaining operational performance and exploring strategic enhancements to further optimize returns. With minimal improvements needed, Fayetteville Storage Solutions is expected to continue providing steady income, positioning it for a successful exit in the near future.

This acquisition further demonstrates Wharton Gladden’s ability to secure high-performing assets in competitive markets, ensuring strong returns for its investors while minimizing operational risk.

About Wharton Gladden & Company:

Wharton Gladden & Company is a uniquely designed boutique investment banking firm that specializes in providing strategic advisory services, underwriting, capital placement and private equity for a diversified client base that includes corporations, real estate developers, financial institutions, investors, municipalities and high net worth individuals.